TOP 10 – PAYMENT PROCESSORS

As digital commerce accelerates worldwide, payment processors serve as the crucial infrastructure connecting merchants, consumers and financial systems

WRITTEN BY: LOUIS THOMPSETT

Advanced fraud prevention, data analytics and embedded finance capabilities are increasingly differentiating processors beyond pure transaction handling.

processing has evolved significantly, from simple credit card transactions to complex omnichannel ecosystems. Today’s leading processors must navigate regulatory frameworks across multiple jurisdictions while supporting diverse payment methods and currencies. The industry continues to consolidate through strategic acquisitions, with technology innovation driving competitive advantage.

Value-added services like working capital solutions and business management tools have become essential components of comprehensive offerings.

Here, Fintech Magazine runs through the top 10 payment processors transforming global payments.

20

June 2025

TOP 10 – PAYMENT PROCESSORS

Cameron Bready, CEO,

Global Payments

TOP 10 – PAYMENT PROCESSORS

PAYONEER

HQ: NEW YORK, NY, USA CEO: JOHN CAPLAN FOUNDED: 2005

Cross-border payments remain a complex challenge in global commerce, an area where Payoneer has carved out its niche. The company’s infrastructure addresses the regulatory complications that typically create friction in international transactions. Unlike processors focused primarily on card payments, Payoneer developed solutions targeting the specific needs of marketplace sellers, freelancers and SMEs conducting business across borders. Recent financial reports indicate growing transaction margins, though the company faces intensifying competition from both traditional banks and fintech challengers in the increasingly crowded cross-border payments space. Name Surname, Job Title, Company Name (Use this caption for

WATCH NOW

John Caplan, border images)

Introducing the Payoneer account

CEO, Payoneer

22

June 2025TOP 10 – PAYMENT PROCESSORS

WORLDLINE

HQ: BEZONS, FRANCE CEO: PIERRE-ANTOINE VACHERON FOUNDED: 1973

Consolidation has characterised Worldline’s approach to the European payments market. Its acquisition of Ingenico expanded its terminal manufacturing capabilities and merchant services footprint across the continent. The French processor maintains contracts with transport systems throughout major European cities, providing contactless fare collection infrastructure. Worldline’s position in European payment systems contrasts with the predominantly American firms that feature prominently in global payment processing. The company continues to develop alternative payment acceptance methods alongside its traditional terminal business as payment technologies evolve in the European market.

Name Surname, Job Title,

Company Name Pierre-Antoine

WATCH NOW

(Use this caption for Vacheron, border images)

Worldline – Payments to grow your world

CEO, Worldline

23

fintechmagazine . com

TOP 10 – PAYMENT PROCESSORS

CHECKOUT.COM

HQ: LONDON , UK CEO: GUILLAUME POUSAZ FOUNDED: 2012

Built during the e-commerce expansion period, Checkout.com developed its payment architecture without the constraints of legacy systems. This technical foundation has attracted digital-native enterprises requiring payment flexibility across multiple markets. Unlike many competitors in the payments space, Checkout.com has maintained private ownership rather than pursuing public markets. The company’s platform processes online transactions across numerous currencies with localised acquiring capabilities in key regions. Its services include payment processing, fraud management tools and business intelligence functions designed for merchants operating internationally.

Name Surname, Job Title,

WATCH NOW

Company Name

Where the world checks out

(Use Guillaume this caption Pousaz for

, border images CEO )

, Checkout.com

25

fintechmagazine .comTOP 10 – PAYMENT PROCESSORS

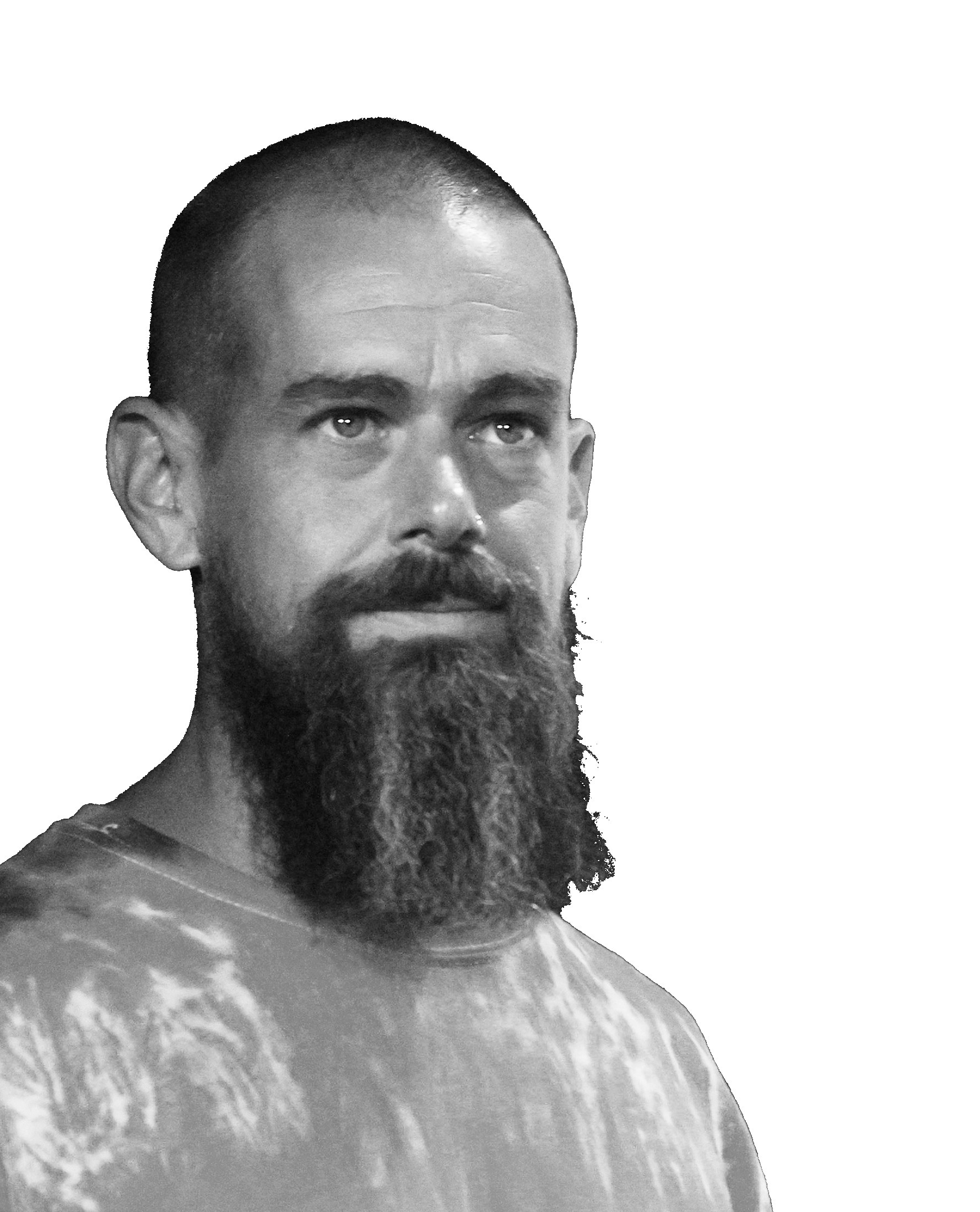

BLOCK ( SQUARE )

HQ : OAKLAND, CA, USA CEO : JACK DORSEY FOUNDED : 2009

Block ’ s white square card reader created a new category in small business payments . What began as a solution for accepting card payments without traditional merchant accounts has evolved into a broader financial services platform . The company currently operates two distinct business lines : the seller-focused Square ecosystem and the consumeroriented Cash App . This structure creates connections between merchant services and consumer financial products . Block ’ s corporate strategy increasingly incorporates blockchain technology initiatives , reflecting Dorsey ’ s interest in decentralised finance applications alongside traditional payment processing services . Name Surname, Job Title, Company Name (Use this caption for

CREDIT : JOE RAEDLE VIA GETTY IMAGES

CREDIT : JOE RAEDLE VIA GETTY IMAGES

WATCH NOW

Block added to Bloomberg’s ‘Ones to Watch’ list

Jack Dorsey, border images)

CEO, Block

26

June 2025TOP 10 – PAYMENT PROCESSORS

PAYPAL

HQ: SAN JOSE, CA, USA CEO: ALEX CHRISS FOUNDED: 1998

As an early entrant in digital payments, PayPal established significant market presence that continues today. The company maintains a vast consumer network alongside its merchant services, with accounts spanning across numerous markets globally. Its acquisition of Braintree in 2013 enhanced its technical capabilities for modern e-commerce implementations. Venmo, PayPal’s peer-to-peer payment service, has achieved substantial adoption in the North American market.

WATCH NOW

PayPal ecosystem

Alex Chriss, CEO,

PayPal

27

fintechmagazine.comTOP 10 – PAYMENT PROCESSORS

FISERV

HQ: MILWAUKEE, WI, USA CEO: FRANK BISIGNANO FOUNDED: 1984

Financial industry connections form a central element of Fiserv’s position in payment processing. Its acquisition of First Data created an entity operating across both merchant acquiring and banking technology sectors. This positioning provides distribution through financial institution relationships for payment services. The Clover point-of-sale platform represents Fiserv’s integrated hardware and software solution for small and medium businesses. The company’s banking technology division delivers core processing and adjacent services to financial institutions. XXXXXX

WATCH NOW

Fiserv: Extending the lead

Frank CEO, Bisignano, CEO Company , Fiserv

28

June 2025TOP 10 – PAYMENT PROCESSORS

FIS

HQ: JACKSONVILLE , FL , USA CEO: STEPHANIE FERRIS FOUNDED: 1968

Corporate restructuring characterises FIS’s recent strategic direction. The company’s divestiture of Worldpay and acquisition of Global Payments’ issuer business represent a significant adjustment to its operational focus. This transition positions the firm more directly toward banking technology and card issuing services rather than merchant acquiring. Financial institutions worldwide utilise FIS technology for core banking functions and payment processing. CEO Stephanie Ferris has emphasised modernisation initiatives including cloud migration and API development.

WATCH NOW

Fintech Talk: Mergers & acquisitions with Nicole Pienkos (FIS) & Alex

Johnson (Fintech Takes)

Stephanie Ferris, CEO,

FIS

29

fintechmagazine .com